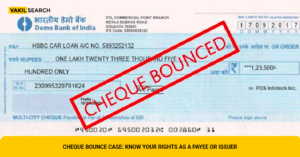

Cheques are a popular form of payment in India, particularly for high-value and business transactions. Cheque bounce, however, is a frequent problem that can have serious financial and legal consequences. This blog explores the nuances of incidents involving bounced checks, the laws that control them, and the possible solutions.

What is a Cheque Bounce?

A cheque bounce occurs when a bank refuses to honor a cheque. This can happen for several reasons, including:

Insufficient Funds: The most frequent cause of a cheque bouncing is a lack of money in the issuer’s account.

Signature Mismatch: A check bounce may result from an inconsistency between the signature on the check and the signature that the bank has on file.

Cheque that has expired: A check that is presented after its three-month expiration date will be returned unpaid.

Inconsistent Amounts: A check may bounce if the amount written on it and the figures on it do not add up.

Account Closure: The check will be returned dishonored if it has been closed prior to its presentation.

https://kaydajunction.com/mediation-and-alternative-dispute-resolution/

The Cheque Bounce Legal Framework

The Negotiable Instruments Act, 1881, Section 138, applies mostly to cases of cheque bounce in India. Cheque bounce is now considered a crime under this law, carrying a maximum two-year jail sentence, a fine, or both. Section 138’s main components are as follows:

Dishonor of Cheque: The check must have been presented before it expired and returned unpaid by the bank.

Notice: Within thirty days of receiving the bank’s cheque bounce memo, the payee is required to demand payment from the drawer by sending a formal notice.

Payment Failure: The payee may bring a lawsuit in court if the drawer does not send the money within 15 days of getting the notice.

The Effects of Cheque Bounce

Cheque bounce can result in severe civil and criminal repercussions.

Criminal Liability: In accordance with Section 138 of the Negotiable Instruments Act, the check drawer may be prosecuted criminally and subject to a fine, jail time, or both.

Civil Suit: In order to recover the full amount of the check, plus interest and legal fees, the payee may also bring a civil suit.

Effect on Credit Score: Recurrent cheque bounces can have a detrimental effect on a drawer’s credit score, making it more challenging for them to get loans or credit in the future.

Reputational Damage: A cheque bounce case has the potential to damage a drawer’s reputation, particularly in the business community.

https://kaydajunction.com/burgerking-vs-burgerking-pune/

How to Handle a Bounced Cheque

You should do the following actions if you are the payee and you have received a bounced cheque:

Gather Information: Hold onto the bank memo, the bounced cheque, and any correspondence with the drawer as evidence.

Provide Legal Notice: Send the drawer a legal notice requesting payment of the cheque amount within 30 days after receiving the bounce memo.

Lodge a Complaint: In accordance with Section 138, you may lodge a criminal complaint against the drawer if payment is not received from them within 15 days of the notice being sent.

Legal Action: A civil lawsuit to recover the amount on the cheque, interest, and legal fees should be considered.

Weapons at the Drawer’s Disposal

Several defenses may be available to you if you are the drawer and have been charged with issuing a bounced cheque:

Payment of Debt: It is possible to contend that the cheque was written as security rather than to pay off a binding legal obligation.

Counterfeiting: You may assert this defense if the cheque was counterfeit or signed under duress.

Not Received: You may contest the lawsuit on this basis if you never received the legal notification.

Counterclaims: Should there have been a disagreement or contract violation that resulted in the cheque’s issuance, you may bring a counterclaim against the payer.

In conclusion

In India, it is a grave violation to bounce cheque, with substantial financial and legal repercussions. Knowing your legal rights and obligations is essential, regardless of whether you are the drawer or the payee. You can defend yourself against unfair charges or get your money back with the help of legal recourse.

Ensuring that cheques do not bounce is crucial for both individuals and businesses to preserve a positive financial reputation. Seeking prompt legal counsel is the best approach to handle the legal difficulties if you find yourself embroiled in a cheque bounce situation.

Do Follow https://khabartaak.com/